Small Business Funding

Access to Capital

Real stories just like yours.

Shar

Shar is the owner of Shar’s Hair, LLC. As one of the only female, Minority-owned, Durable Medical Equipment (DME) businesses serving Indiana, Ohio, and Michigan areas, Shar found support from BOI lending to purchase inventory and upgrade software systems to meet the demand of her market.

Summer

Summer is a new entrepreneur who is launching a startup. She needs $20,000 of working capital to operate her business before she has steady sales. Because Summer is a first-time entrepreneur, a business coach is able to help refine her business model and projections until she is loan-ready.

José

José is a single father who runs a home-based baking business. He needs $5,000 to make upgrades to his space. Even though he doesn’t have a strong credit score, José was able to demonstrate his financial stability which allowed him to receive a BOI loan for his long standing business.

Meet the lending team

LENDING.

Frequently Asked Questions.

Have more questions about lending?

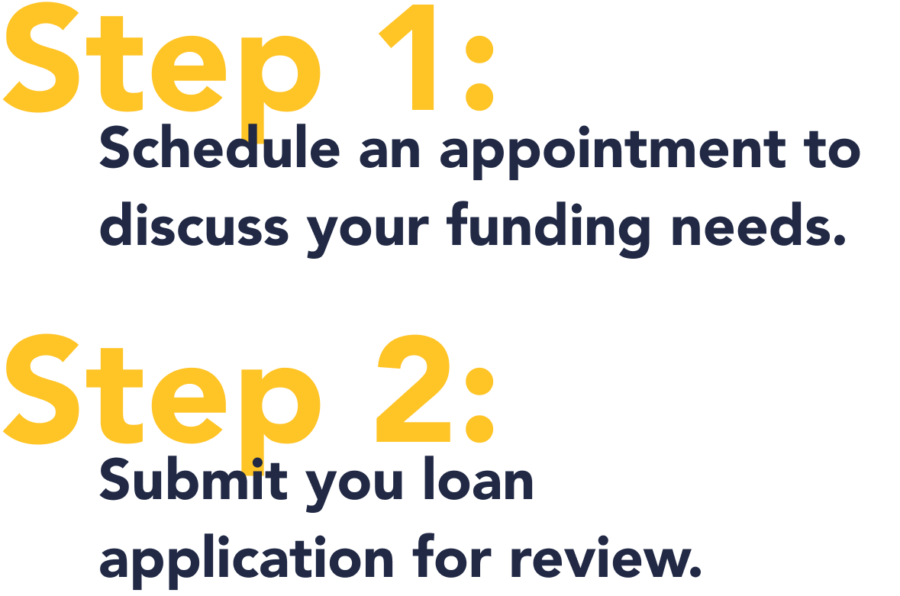

Knowing where to start can be a challenge. Let us help!

Join Our Newsletter

Get updates to your inbox with the latest news and updates from Indy Chamber