News Alert from Lanteigne Tailored Planning – Thrivent: The Debt Ceiling and Deficit Spending

The following information is provided from Lanteigne Tailored Planning with Thrivent Financial. If you have any questions or would like to follow up, visit connect.thrivent.com/lanteigne-tailored-planning or call (317) 641-5000.

On January 19, 2023, the outstanding debt of the U.S. government reached its statutory limit, commonly called the debt ceiling. The current limit was set by Congress at about $31.4 trillion in December 2021.

On the day the limit was reached, Treasury Secretary Janet Yellen instituted well-established "extraordinary measures" to allow necessary borrowing for a limited period of time. While Yellen projects the extension will last until early June, the Congressional Budget Office (CBO) estimates it may last until sometime between July and September. However, the CBO cautions that if April tax revenues fall short of its projections, the Treasury could run out of funds earlier.2–3

Flexibility vs. Fiscal Fights

A debt ceiling was first established in 1917 to give the federal government more flexibility to borrow during World War I. Before that time, all borrowing had to be authorized by Congress in very specific terms, which made it difficult for the government to respond to changing needs.4

The modern debt ceiling, which aggregates almost all government debt under one limit, was established in 1939. Since 1960, it has been raised, modified, or suspended 78 times, mostly with little fanfare. That changed in 2011, when a political battle over the ceiling pushed the Treasury so close to the edge that Standard & Poor's downgraded the credit rating of the U.S. government.5–6

The debt ceiling limits the amount that the U.S. Treasury can borrow to meet financial obligations already authorized by Congress. It does not authorize future spending. However, beginning with the bitter battle of 2011, it has been used as leverage for partisan negotiations over government spending. With the White House and the House of Representatives — which must authorize spending — held by different parties, this year's negotiations could be particularly difficult.

Potential Consequences

If the debt ceiling is not raised in a timely manner, the U.S. government could default on its financial obligations, resulting in unpaid bills, higher interest rates, and a loss of faith in U.S. government securities that would reverberate throughout the global economy. While it's unlikely that the current situation will lead to a default, pushing negotiations close to the edge can be damaging in itself. It was estimated that the 2011 impasse cost U.S. taxpayers $1.3 billion in increased borrowing costs in FY 2011 with additional costs in the following years.7

The Deficit and the Debt

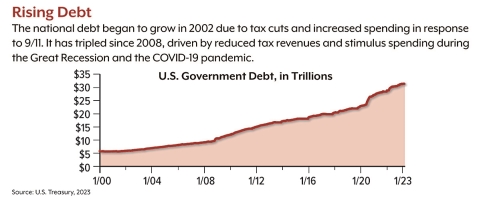

Put simply, the federal government runs at a deficit when tax revenues are not sufficient to meet spending obligations. Federal spending has outpaced revenue for the last 50 years, except from 1998 to 2001.8 Annual budget deficits add to the national debt.

The current debt of $31.4 trillion is the highest in U.S. history.9 However, measuring the debt as a percentage of gross domestic product (GDP) provides a better comparison over time. More specifically, economists look at debt held by the public — funds the government has borrowed to meet operational expenses and liabilities, primarily through issuing Treasury securities. Interagency debt — funds borrowed from government accounts such as the Social Security trust funds — is also subject to the limit but does not directly affect the economy or federal budget.

At the end of fiscal year 2022 (September 30, 2022), debt held by the public was equivalent to 97% of GDP. In 2019, before the pandemic, it was 79% of GDP, and in 2007, before the Great Recession, it was 35%. Both of these crises caused explosions of the deficit and debt due to lower tax revenues and high spending on government stimulus programs. The last time the debt exceeded current levels was at the end of World War II.10-11

In a new February 2023 analysis, the CBO projected that the debt will rise steadily over the next decade to 118% of GDP in 2033, which would be the highest percentage in U.S. history. The driving forces behind this increase would be higher spending on Social Security and Medicare, and rising interest costs (due to increasing debt and higher rates). If current laws remain unchanged, the debt is projected to rise even more quickly in the next two decades, reaching 195% of GDP in 2053.12

No Easy Answer

The only way to change this trajectory is to increase revenue, reduce spending, or both. The rosiest scenario would be decades of high GDP growth that increases revenue at current tax rates, but this seems unlikely. The CBO projects real (inflation-adjusted) GDP growth to average a tepid 1.7% annually over the next decade.13 Raising tax rates may be necessary, but that is always a difficult political option.

There is also little room to maneuver on the spending side. Only 28% of federal spending is "discretionary," meaning Congress can set amounts through annual appropriations bills, and almost half of that spending goes to national defense, which few leaders would want to cut in the current global climate. The rest is mandatory spending, including Social Security and Medicare (which will account for nearly 36% of federal spending in 2023) and interest on the national debt.14 While both parties have indicated that Social Security and Medicare are off the table, other mandatory spending could be reduced through Congressional action.

The White House is expected to release its budget proposal for FY 2024 in March, followed by a counterproposal from House Republicans in April, setting up what is sure to be an intense period of budget negotiations. President Biden and House Speaker Kevin McCarthy have already begun to discuss the debt ceiling issue, and it remains to be seen whether the ceiling can be addressed outside of the budget process or whether it will be caught in the crosshairs. In either case, the ceiling will have to be raised or suspended in order to maintain U.S. government operations.

U.S. Treasury securities are guaranteed by the federal government as to the timely payment of principal and interest. The principal value of Treasury securities fluctuates with market conditions. If not held to maturity, they could be worth more or less than the original amount paid. Forecasts are based on current conditions, are subject to change, and may not come to pass.

Member Stories

Second Helpings Hosts Souper Bowls Local Soup Competition Feb. 4

Join Our Newsletter

Quick Connect Links